A truly single HR and payroll software for finance executives

Easy-to-use HR tech to reduce errors, increase security and boost your bottom line

WHY PAYCOM

Because your investment should prove its worth

When everyone in your company relies on HR tech, you can’t afford a purchase that falls short. Each separate system an HR or payroll pro has to log in to costs valuable resources and could leave your organization exposed. Plus, when admins can’t trust their tools to produce accurate data or help reduce your company’s liability, it chips away at the bottom line, too. And when that tech isn’t easy for employees to fully use, was it really worth it?

You should never just hope your investment will pay off. That’s why Paycom’s truly single software automates manual tasks, eliminates costly data reentry, scales with your business, and measures and maximizes ROI. Just one login and password give HR access to all the tools they need to shore up compliance, empower employees and make the most of your resources.

Believe the hype

1,000,000+

5-star app ratings

Capterra

App store

Google play

HOW WE HELP

One HR software to drive EBITDA

When operations stall, so does your role’s effectiveness. But how do you amplify efficiency and eliminate errors that could derail your financial planning? With our automated tech, it’s easier than you think.

Simplify your general ledger

If a general ledger is the backbone of your business, why complicate it with a convoluted process? Paycom brings clarity to your general ledger while empowering you with even greater control. You’ll enjoy real-time reports, crystal-clear audit trails, customizable file layouts and infinite mapping — all in our single software.

Never miss out on WOTC

Finding opportunities to help your organization save shouldn’t be hard. With our Tax Credits software, it’s simple. As soon as a prospective employee applies, Paycom automatically finds, secures and administers eligible tax credits. And if we don’t produce a positive result, you pay nothing for the search.

End costly reentry

Every mistake has a cause. And when it comes to bad data, manual work is usually the culprit. Since data flows seamlessly across Paycom’s single software, it stays secure and consistent because HR doesn’t have to reenter a thing. No more trying to stitch together systems that don’t accurately communicate with each other or prevent costly errors.

Maximize your ROI

Of course, every HR tech provider will say they boost ROI. But that’s not enough. You need to be able to measure it. Paycom makes it easy to ensure your purchase is being used to the fullest. We use Ernst & Young data to calculate your savings through employee usage, as well as opportunities to achieve even higher ROI.

Simplify security

All it takes is one small opening for a cyberthreat to drain your profits. With stakes this high, we know our security standards have to exceed all expectations. That’s why our tech is formally audited and ISO- and SOC-certified. Plus, we operate our own data centers and hold multiple Tier IV certifications.

Lower your liability

Fines, penalties and unexpected audits keep you from investing in growth-driving areas. But acing compliance doesn’t have to be a guessing game. Our software gives you a big-picture view of unemployment claims, workplace injuries and illnesses, and more. Paycom even lets HR easily and automatically generate reports — for FLSA, ACA and the EEO-1 — in their government-required formats without wasting time manually creating them.

Relieve your payroll tax headaches

Manually managing complex payroll taxes dials up the pressure on your HR team and could leave your company on the hook for fines and penalties over missed deadlines and filings. We’ll take that stress off your organization with our payroll tax service. Our world-class specialists automatically debit your taxes, remit them by their due dates and file your federal and state returns online. Paycom even converts and balances your year-to-date payroll tax totals.

Fine-tune fiscal planning

As employees grow with your company, you have to juggle rewarding their efforts while protecting your budget. Our performance and compensation budgeting tools make striking that balance easy. They give HR insight into potential adjustments to help your company make the best, equitable choice for your overall compensation strategy.

FULL-SOLUTION AUTOMATION

Automated tech to maximize your purchase

Let’s face it: If your HR pros and admins perform any busywork, your bottom line takes a hit. From recruiting to payroll processing and beyond, Paycom automates tedious tasks even as your business grows. As you generate revenue, we’ll make sure manual processes don’t hold your profits back.

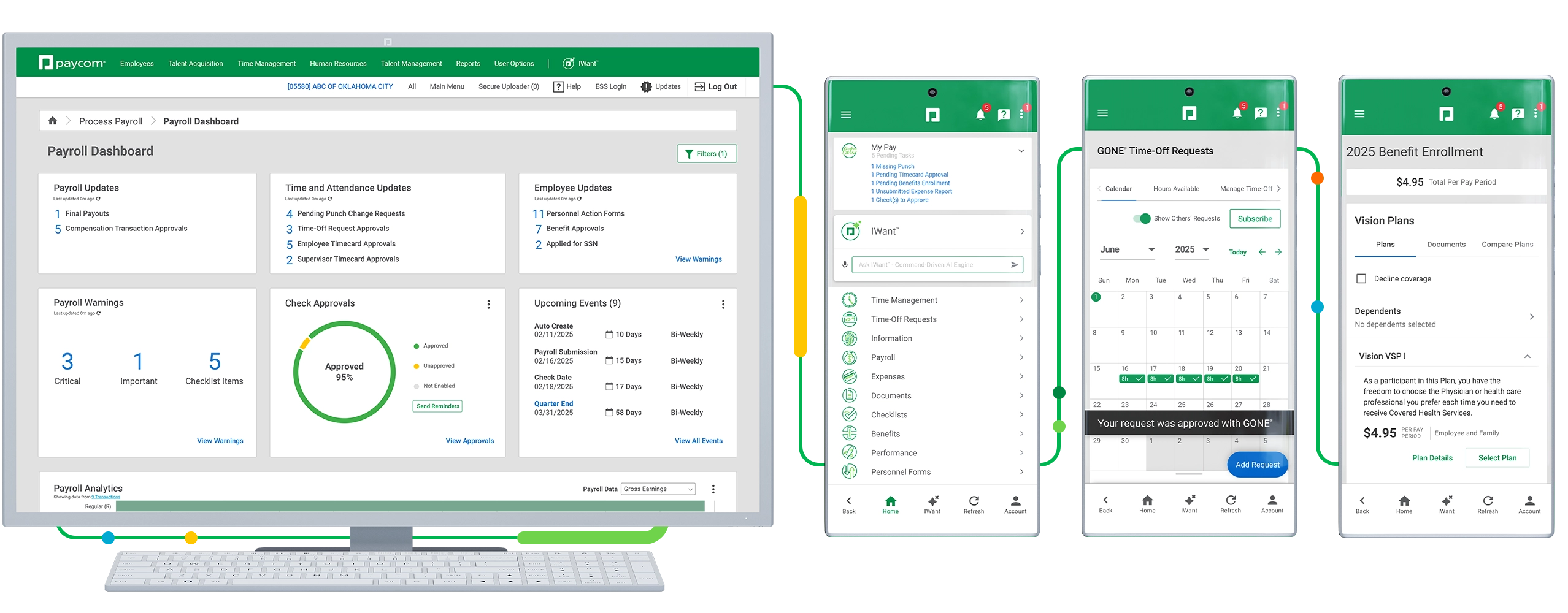

Payroll perfected

Payroll is likely your biggest expense. Preventable mistakes and wasted effort only add to it. Since Paycom is a truly single software, our payroll self-starts each pay period by pulling live data on time, benefits, expenses and personnel data. Then it automatically flags errors and guides employees to fix them before submission. This frees your payroll admins from costly manual work and gives you an extra layer of protection against expensive, retroactive corrections.

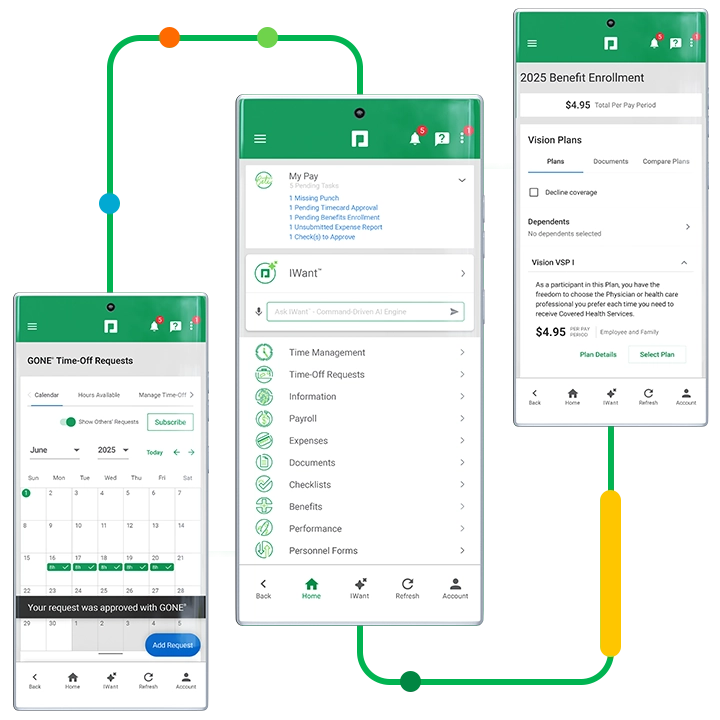

Make the most out of benefits

Tired of investing in benefits packages that employees don’t use? Even the most competitive selections can fall flat when employees don’t understand them. Our single software streamlines open enrollment by walking employees through an intuitive, step-by-step process that lets them test the impact of their benefits on their pay. We can even automatically and securely sync their elections with your carriers — without any extra effort on HR’s part.

Simplify time-off decisions

When HR, managers and admins fumble with time-off requests, it creates costly bottlenecks. Even worse, the wrong time-off decisions during peak periods could force you to sink money into avoidable overtime caused by understaffing. Our automated time-off functionality instantly approves or denies requests based on criteria you set, so you always have the coverage you need.

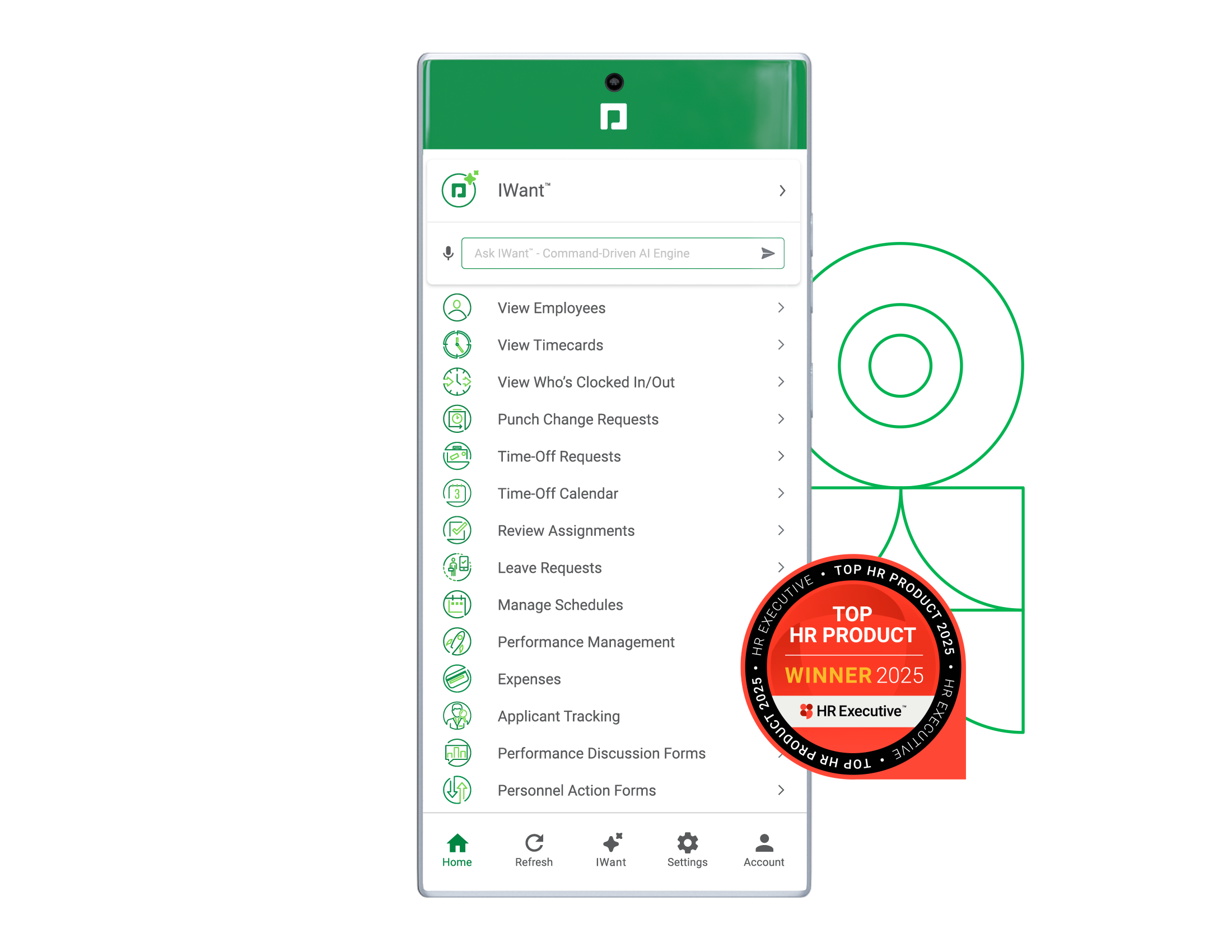

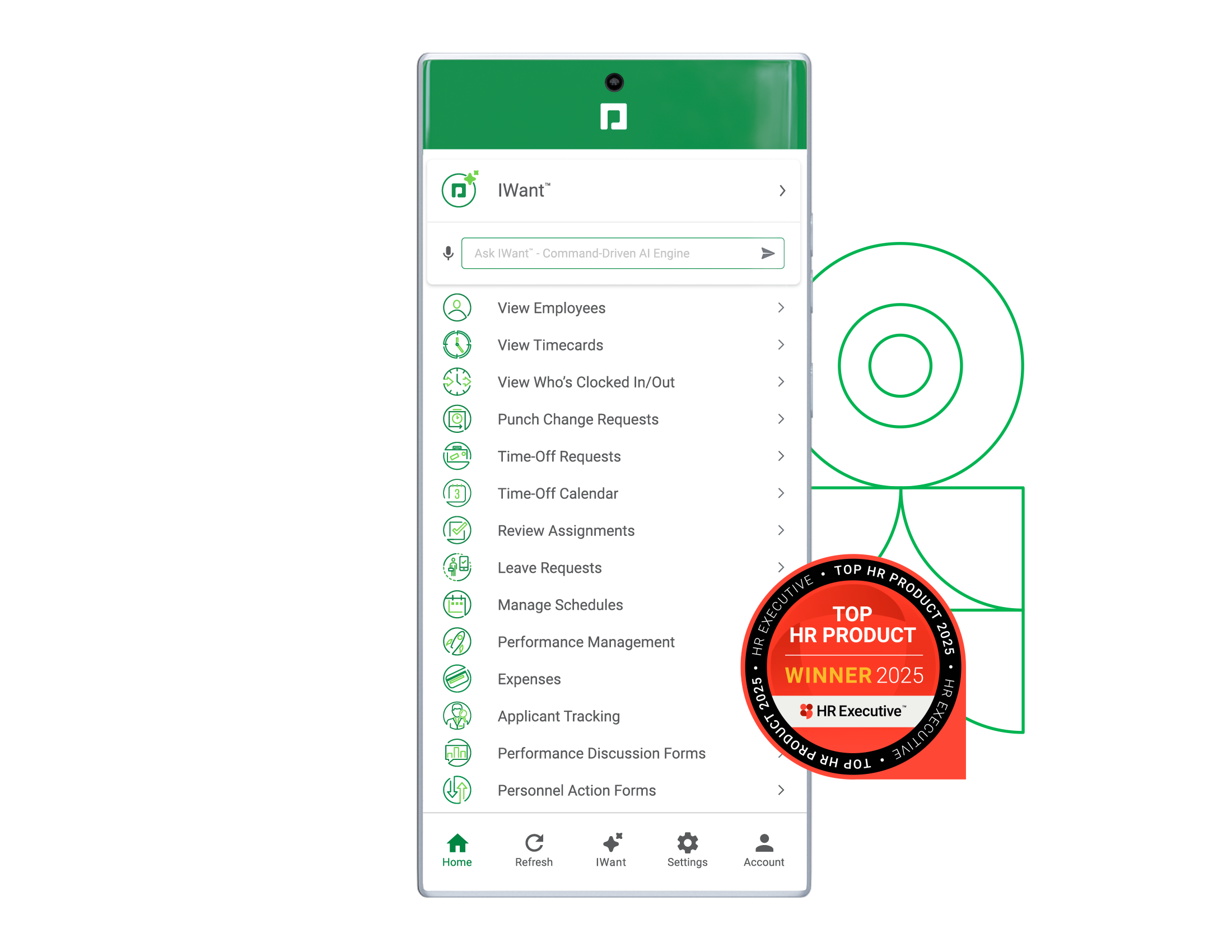

IWANT

The employee data you need — all at your command

We’ve revolutionized how users find and access employee data. Instead of hunting for the info you need, simply ask IWant™ — the industry’s first command-driven AI engine in a single database. It searches employee profiles and management dashboards to deliver instant, accurate answers.

SEE WHAT FINANCE EXECUTIVES ARE SAYING ABOUT PAYCOM

Frequently asked questions

Learn more about HR software for finance executives

As an industry, HR and payroll software seeks to turn manual, recurring tasks into automated ones. As a result, those team members regain lost time.

However, the right HR and payroll software does far more. Because we built ours on one — and only one — database, any information entered automatically flows systemwide, rendering duplicate data a thing of the past. Data accuracy increases, which helps bolster your company’s compliance.

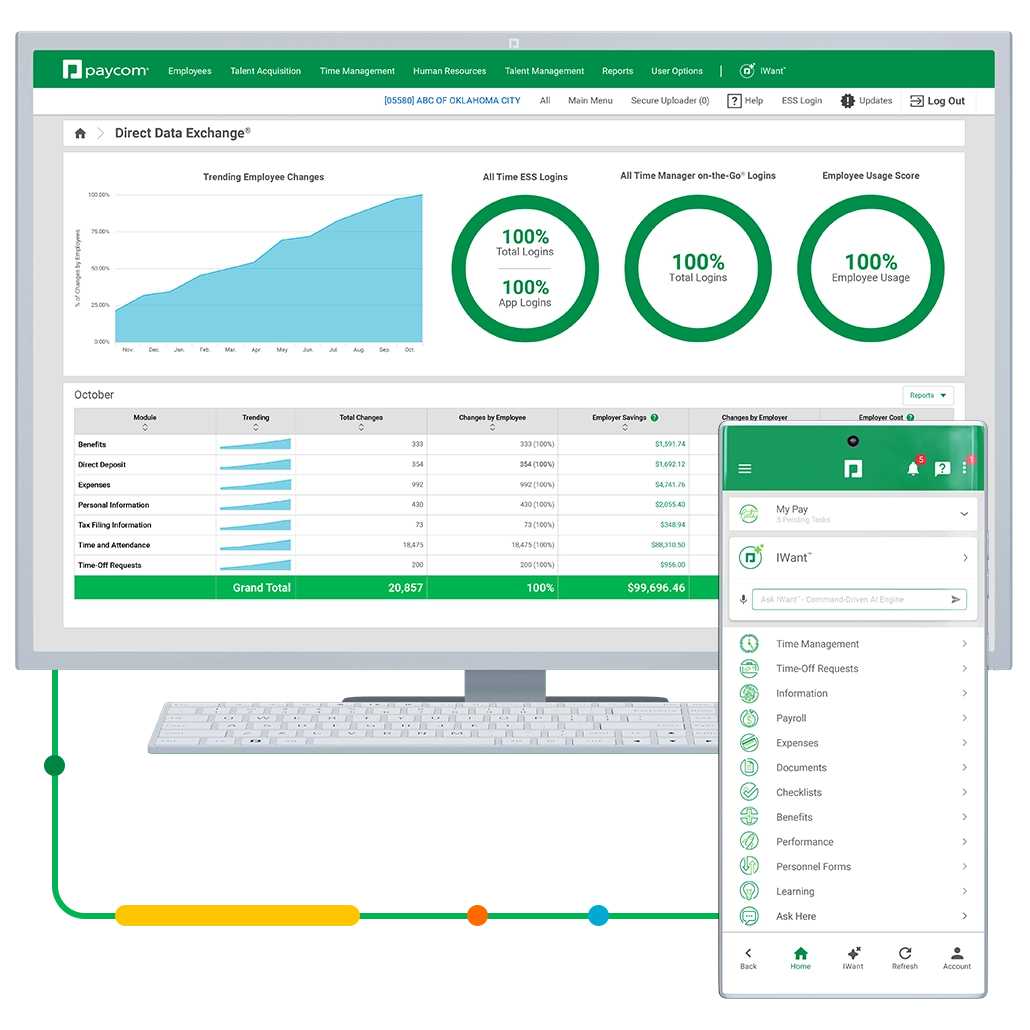

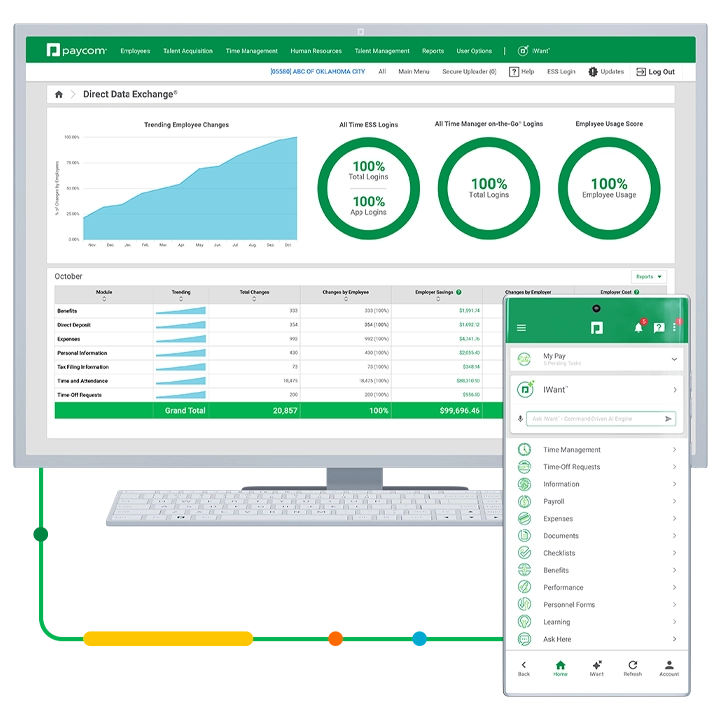

Included in your Paycom software, Direct Data Exchange® is the industry’s first tool for measuring employee adoption and usage patterns of our HCM tech and how those impact your bottom line.

With visibility at the company or individual level, it reveals the true cost when employees don’t manage their own data — and the efficiencies you gain when they do — so you know exactly where to focus to improve ROI. Making those improvements increases accuracy of company data and can eliminate paying for needless duplicate tasks.

In Paycom’s single software, you’ll find an array of tools to make your job easier and more efficient. With instant, 24/7 access to workforce data and other insights, you’ll be able to make more informed decisions, as well as:

- help keep your organization compliant

- gain peace of mind regarding data security and scalability

- track and take action on tax and banking-related info from one dashboard

- drive ROI companywide

- see measurable results on the bottom line

Our Report Center allows users to create their own reports based on a variety of fields, filters, sorting options and file formats. If the data exists in Paycom, you can report on it for future budget, workforce and strategy planning. This helps finance professionals and executives make better and more informed financial decisions.

That includes insights on expenses, garnishments, labor allocation, wages, taxes, compensation changes, salary grades, compa-ratios and so much more. Plus, with on-demand analytics, you can set up custom dashboards to review data, track trends, view data as graphs, and monitor activity and changes.

Paycom’s software supports payroll accounting team members in a variety of ways. With payroll tax management functionality, our software mitigates your organization’s responsibilities in this area. We debit your payroll taxes, deposit them on their due dates and remit your filings — all on your behalf. Plus, our single software:

- generates payroll reports in a snap

- makes it easy to map your payroll data for uploading to your general ledger

- automatically leads employees to verify accuracy of their paycheck before payroll submission

- and more

Our software’s GL Concierge tool generates perfectly mapped general ledger reports for easy direct import, even across multiple sectors within one business entity. No longer will you be tasked with keying payroll data into your accounting software each and every pay period.

For agility, GL Concierge keeps accounting current on changes affecting the payroll ledger, such as new earnings, deductions and labor allocations. Enjoy a visually familiar, spreadsheet-like interface so you can organize your payroll accounting data in a way that’s meaningful to you. Managing multiple file layouts and grouping accounts is a breeze.

In addition to a wealth of reports and general ledger functionality, our HR and payroll technology helps:

- maximize ROI

- drive EBITDA

- minimize compliance risks

- track and manage expenses

- manage payroll taxes

- lower labor costs

- locate and secure WOTC tax credits

- manage tax and banking info on one dashboard

- and more, with efficiencies across the board